Tolib Rakhmonov

Image source: www.gazeta.uz

Introduction

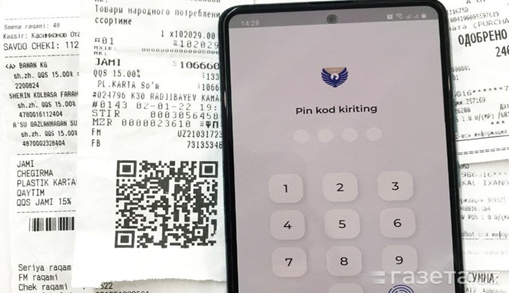

Presidential Decree that was adopted in 2021, created an opportunity for individuals to return 1 % of the amount of their purchases made in retail, catering and household services facilities (cashback system). Two years later, the President adopted a new Decree, which established that from May 1, 2023, individuals that are included in the “Social Protection Single Registry” (low-income individuals) while purchasing lamb, poultry, beef, eggs, vegetable oil at retail facilities have an opportunity to return the cashback in the amount of 12% (value-added tax) of the cost of the above-mentioned products from the republican budget. For this, they have to register these purchases in a mobile application of tax authorities by scanning the fiscal stamp of the purchase receipt using a matrix barcode (QR code). Even though an introduction of this system has created a unique opportunity for citizens to save their money, it also led to negative consequences, such as fraud cases, abuse of rights.

In this blog post, I will try to analyze how this system has justified itself, the shortcomings of this system, the opportunities for the low-income individuals to receive increased cashback, and I also offer alternative solutions to eliminate the shortcomings of this system.

Consequences of the introduction of the cashback system

The introduction of the cashback system contributed to an increase in tax revenues. According to the State Tax Committee, thanks to the cashback system, the volume of tax revenues for 10 months of 2022 amounted to 123.8 trillion soums, and since the beginning of 2022, receipts from value-added tax (VAT) have increased by 33%.

Despite the fact that the cashback system has shown positive results, cases of illegal receipt of cashback from other people’s purchase receipts have begun to occur. For example, in April 2022, the cashier of the capital company “A.A.” citizen B. R. registered 152 cash receipts of customers in the amount of 1.6 billion soums, for which he was credited with cashback in the amount of more than 16.48 million soums.

In order to prevent such cases, the government adopted a Decree which granted the State Tax Committee the right to cancel the illegally accrued cashback amounts and refuse to refund 1% of the purchase amount of products and services if the fact of the purchase of this product (service) exactly by this individual is questionable.

Another problem is that many businesses providing services in the retail sector do not issue checks while selling products and services to customers. Although the Tax Code establishes a financial sanction in the amount of 5 million soums for not issuing checks, some sellers continue to ignore this rule. To prevent such cases, the Tax Committee has developed a “Soliq hamkor” system, through which the customer may inform the tax authorities about the facts of violation of the rules on issuing checks.

Does the VAT refund mechanism (cashback) work for the low-income individuals?

As much as the state has tried to support socially vulnerable segments of the population through the cashback system, there are doubts about its effectiveness. Why?

Firstly, the state connects the value-added tax (VAT) refund mechanism with the purchase receipts. But in practice, most low-income people buy essential products at markets (not supermarkets) at low prices. And in the markets, practically no receipt is issued for the purchase, and accordingly, it is impossible to use this benefit without a receipt.

Secondly, there may be problems with communication and Internet access to log in to the “Soliq.uz” system and scan the receipt. Let’s say a citizen from remote regions received a check for the purchase of goods in order to take advantage of the benefit. Does he have enough resources to install the Soliq.uz application and scan the receipt? Do low-income people have smartphones? Will there be an access to the Internet? Unlikely. Citizens in need of social protection mostly use phones that do not have a camera and Internet access, or they do not use phones at all.

Finally, the VAT refund procedure does not apply to all food products, but only to some, in particular beef, lamb, vegetable oil, eggs, poultry meat. Taking into consideration that the low-income individuals purchase these products in smaller quantities, the amount of cashback will also be minor. There is a high probability that the cashback amount may not interest them.

Considering the above, we can say that in practice, the mechanism of VAT refund (cashback) to the poor cannot fully work. In turn, some citizens began to use a new opportunity for fraud and personal enrichment. For example, a citizen with the purpose of personal enrichment, illegally registered a check for 650 million soums in the mobile application “Soliq”, another citizen scanned a check for 481 million soums. The scheme here is extremely simple – outsiders make multimillion-soums purchases, and then, for a small percentage, transfer checks for registration to persons who are included in the “Social Protection Single Registry”.

Alternative solutions

It was emphasized above that low-income individuals will not be able to take advantage of the benefit, which provides the refund that is equal to 12 % of the amount of purchased goods. The main reason is that the government connects the VAT refund mechanism with purchase receipts. To support low-income individuals, the government should introduce a different order of financial assistance that is not related to purchase receipts and VAT in general. For example, having calculated the average monthly expenses of low-income people for vital products, government, based on these expenses, can allocate a certain amount of money to citizens included in the “Social Protection Single Registry”.

Taking into account that a certain part of the population does not have smartphones for scanning checks, it is necessary to open special kiosks in public places near ATMs or install automatic machines for scanning checks and receiving cashback. For instance, in Korea tax refunds can be received at the tax refund counter or kiosk.

The next proposal is that government should introduce a mechanism for receiving cashback after identifying the identity of the consumer. That is, in order to scan the receipt for cashback, the consumer must pass identification through the “FACE-ID” system or in the tax authorities. This method allows to prevent fraud and misuse of other people’s checks to receive cashback.

Another feasible solution is to provide the low-income people with bank cards free of charge to receive the cashback. It is known that cashback refund occurs through a bank card in non-cash form. Due to the lack of a permanent job, a number of citizens earn wages in cash. Consequently, they practically do not use bank cards. In order to fully realize their rights to receive cashback, the state should provide the citizens included in the “Social Protection Single Registry” with bank cards free of charge. For example, in Brazil tax refunds occur through a bank card provided by Banrisul (the bank of the state of Rio Grande do Sul), called Citizen Card.

Strengthening state control in the markets is no less important. Government agencies should control that all sellers, not only in supermarkets, but also in markets, that issue a purchase receipt. In addition, it is necessary to establish liability in the legislation in the form of suspension of activity for a certain period (for example, from 10 to 30 days) for the systematic refusal to issue a receipt to the consumer.

The next suggestion is to increase the cashback amount. Cashback for the low-income people for the purchase of certain products is 12% of the purchase amount, and for the rest of the population is only 1%. Consumers are not interested in coming into conflict with the seller demanding the issuance of a check, since the amount of cashback is insignificant. An increase in the amount of cashback by 5% will undoubtedly intrigue most consumers to demand receipts and scan them.

Regarding fraud and misuse of other people’s checks to receive cashback, it is necessary to establish either legal responsibility or financial sanctions. In the Code of administrative responsibility, it is necessary to establish a separate article entitled “Illegal receipt of cashback by misappropriating checks of other individuals.” The public danger of this illegal action is high, as it can cause significant damage to the state budget.

Conclusion

In conclusion, I want to note that, in general, the cashback system has given an effective result not only in terms of replenishing the state budget, but also material incentives for the population. But it is still necessary to improve legislation and reconsider the issue of VAT refund to low-income people. The proposals mentioned above may interest more citizens to use the right of receiving cashback, thereby increasing tax revenues. Administrative responsibility for the use of purchase receipts of other individuals can significantly reduce the cases of misuse of other people’s checks to receive cashback.

Cite as: Tolib Rakhmonov, “How effective is the cashback system from purchases?”, Uzbekistan Law Blog, 26.12.2023.

June 1, 2024 at 4:22 pm

Very well written blogpost and great structure👍